Agenda-setting intelligence, analysis and advice for the global fashion community.

Rothy’s wants to be everywhere.

In the last year alone, the footwear brand opened nine stores in six states, and began stocking its flats at Nordstrom, Liberty London, Bloomingdale’s and Le Bon Marché, among other retailers. Next up: a partnership with 1 Hotels to sell clogs and other popular styles in the luxury boutique chain’s lobbies.

It’s a remarkable comeback for a brand that came close to becoming a one-hit wonder like so many other direct-to-consumer start-ups of the 2010s. Rothy’s quirky, machine washable, commuter-friendly flats, made from recycled plastic, were a hit upon their 2016 launch. But sales slowed soon after the company sold a 49.9 percent stake to Havaianas maker Alpargatas at a $1 billion valuation in 2021, as its Millennial customers moved on.

But it turns out Gen-Z fashion girls are as enamoured as their older siblings with the shoes’ sleek silhouette. Rothy’s has tailored its approach; while it still talks plenty about how its shoes are comfortable and environmentally friendly, in the midst of the ballet flat craze, they’re trendy too. The brand is also putting out its own spin on other popular styles, including clogs, which were introduced in 2023.

ADVERTISEMENT

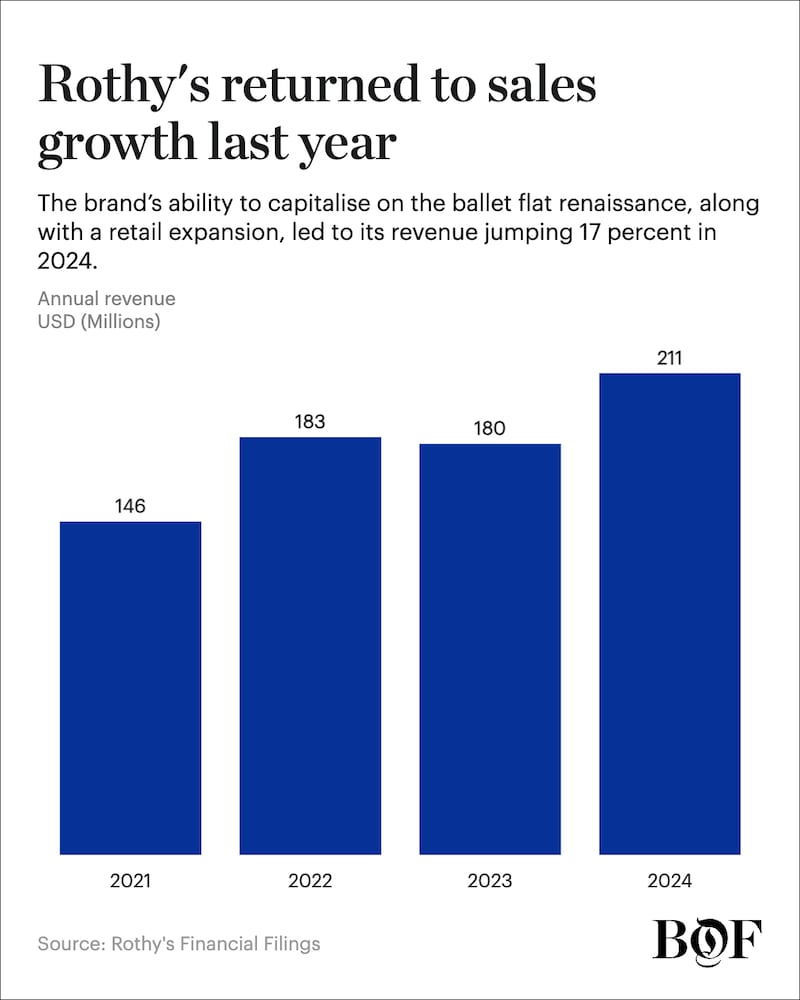

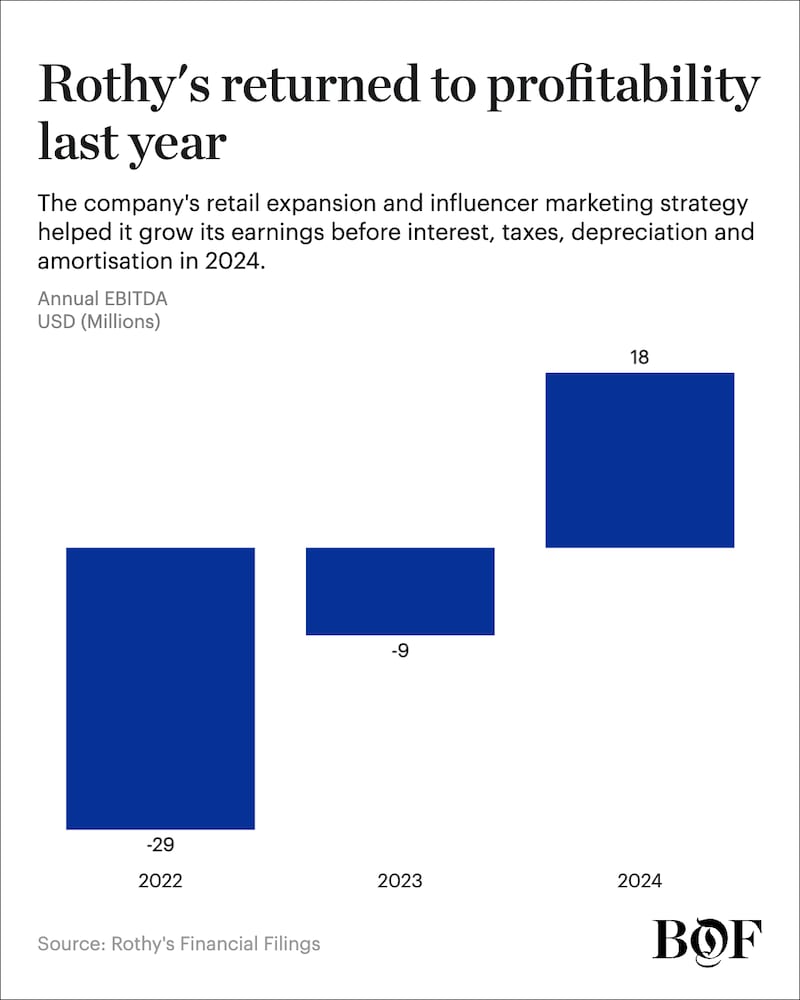

After dipping slightly in 2023, sales were up 17 percent to a record $211 million last year. In the first quarter of this year, sales were up 27 percent from a year ago.

The next year, however, will test Rothy’s momentum. The brand can partially thank a decline in high heels and resurgence in flats for its success, but that trend could easily reverse. The brand also manufactures all of its shoes at a factory it owns in China, which exposes it to the Trump administration’s tariffs and makes forecasting growth harder, said Dayna Quanbeck, Rothy’s president.

Rothy’s is exploring new manufacturing partners in Brazil, where Alpargatas is based, Quanbeck said. The brand is also introducing more silhouettes, like an almond-toe slingback it launched this year and a penny loafer arriving later this month. It’s a formula that’s worked well for brands like Crocs, Ugg and Birkenstock, which find ways to remind customers what they like about their brands, even when introducing something new.

“At the end of the day, it all comes back to great products,” said Michael Prendergast, managing director in the consumer and retail group at consulting firm Alvarez & Marsal. “That’s a very elementary foundational element that gets very lost.”

Becoming a Fashion Girl

When Rothy’s launched, it instantly attracted a new generation of shoppers with its pointed-toe v-shaped ballet flats that could be thrown in a washing machine. But it was the shoe’s function, not its trendiness, that was the primary draw. For a time, sustainability provided the cool factor, but this messaging wore thin as consumers began to tune out green marketing.

Co-founders Stephen Hawthornthwaite and Roth Martin stepped down in 2023, and the company named former Old Navy executive Jenny Ming as chief executive. Under Ming, Rothy’s has touted itself as a fashion-first label.

The brand’s $159 slip-on clogs have been consistent bestsellers as it releases new iterations including versions with buckles. A $130 almond-toe slingback flat in a black and cream two-tone cap-toe style is reminiscent of a pair sold by Chanel for nearly 10 times the price.

“As we look out at the innovation that’s coming in the product in the future, it’s really hard not to be bullish,” Quanbeck said. “We’re really leading with a steady hand and we’re building a brand for the ages.”

ADVERTISEMENT

Instead of launching glossy ad campaigns, Rothy’s has partnered with influencers who have fashion-forward audiences. Many already posted about the shoes for free before working with the brand.

In April, Rothy’s co-hosted a closet sale with Substack writer Erika Veurink at its store in New York’s Nolita neighbourhood, to promote Earth Day. Veurink, who has over 30,000 followers on Instagram, helped Rothy’s Mary Jane flats go viral in 2023 when she wrote in New York Magazine about wearing them while walking 15,000 steps in Italy.

On TikTok, Rothy’s earned media value — a measure of buzz — more than doubled between March 2024 and April 2025, according to influencer marketing platform CreatorIQ, as young women post videos — some paid for, some not — unboxing new pairs, styling their favourites or alerting their followers about restocks.

Rothy’s fashion-forward approach is also helping its wholesale business. Since picking up Rothy’s last July, Bloomingdale’s has included its flats in displays featuring other on-trend brands. The fact that they’re comfortable is “icing on the cake,” said Jennifer Jones, the department store’s senior vice president and general merchandise manager of women’s accessories.

“For our customer, comfort is important, but fashion comes first,” she said.

More Than a Fad

Even as it rides the latest trends, Rothy’s is still making all of its shoes from recycled plastic. Later this month, the brand is launching its version of a penny loafer — typically made with leather that requires longer break-in periods — in its signature soft knit.

“The idea isn’t only to be a copycat out there of what the trend is, it’s how we do it in the Rothy’s way,” said Jamie Gersch, Rothy’s marketing chief.

That also means continuing to talk about sustainability, particularly Rothy’s messaging around reducing production of single-use plastic bottles, which the brand has campaigned for from the start.

ADVERTISEMENT

In April, the brand held a bottle swap at Nordstrom’s flagship store in New York where visitors could trade plastic bottles for refillable Hydro Flask tumblers. The company teamed up with 1 Hotels, in part because the hospitality chain puts water stations in its room rather than plastic bottles, Gersch said.

“Consumers understand recycling plastic bottles … It’s not the only way to be sustainable, but it is a fairly understandable one, and [Rothy’s] really remained true to that,” said Beth Goldstein, a footwear and accessories analyst at Circana.

And while more new styles are in the works, there are limits to how far Rothy’s will expand its brand.

“If a stiletto is the next biggest shoe trend … Rothy’s isn’t going to participate,” Gersch said. “It doesn’t fit the style, comfort and sustainable filters that we have.”