Agenda-setting intelligence, analysis and advice for the global fashion community.

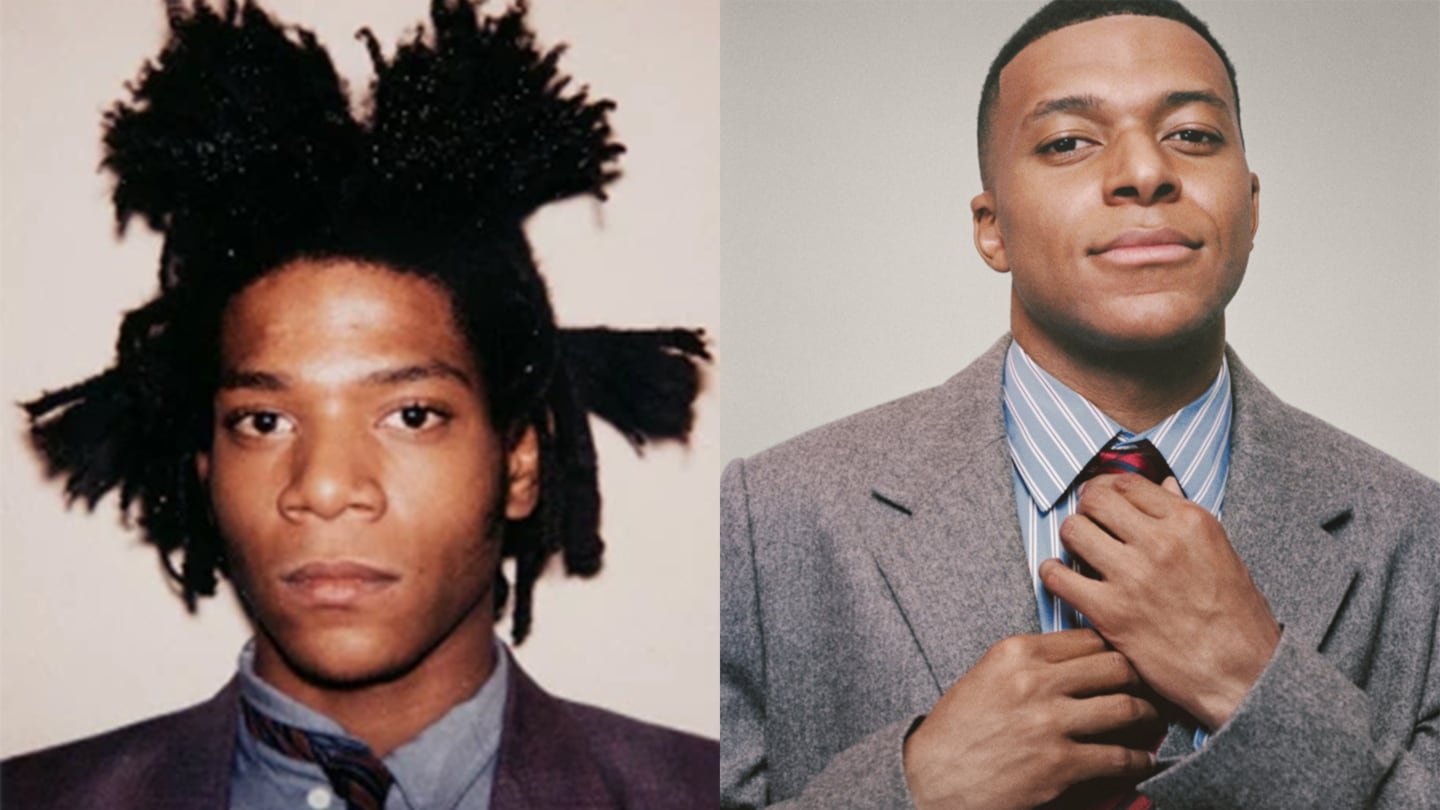

PARIS — Football superstar Kylian Mbappé knots a striped necktie over a blue-and-white oxford shirt and boxy grey jacket. It’s the first Dior menswear look by Jonathan Anderson to be revealed to the public ahead of the designer’s debut at the brand this Friday during Paris Fashion Week and a clear nod to a 1982 portrait by Andy Warhol of Jean-Michel Basquiat wearing a similar look, which the brand posted on social media a few days earlier.

Drawing on disruptive figures in post-modern art like Basquiat and Warhol hints at how Anderson is likely to embrace his role as a cultural curator at Dior. While cultivating ties to celebrity, the arts and culture writ large is a priority for all creative directors working today, few have managed to position themselves so thoroughly in the cultural conversation as Anderson, who during 10 years at LVMH stablemate Loewe published art books and fanzines, mounted design exhibitions, sponsored a craft prize and created the costumes for blockbuster films and concert tours. His fashion generated memes, which in turn became new fashion.

Taking a well-known style reference like Basquiat and translating it into an easy-to-grasp campaign fronted by France’s biggest football star is also a first glimpse at how Anderson may need to adapt — and broaden — his approach for a far bigger challenge.

At Dior, Anderson is tasked with relaunching a brand with estimated revenues several times bigger than Loewe’s, where conceptual designs took centre stage. That the Basquiat portrait is by Warhol — an artist for whom mass media and consumer capitalism were ongoing fixations, and whose Factory could be seen as an analogue to Dior’s “beehive” (founder Christian’s favourite metaphor for the couture house) — hints that his latest endeavour won’t shy away from commercialism. A similarly collaborative vision to Warhol’s Factory may also be essential for Anderson to thrive in his new role, which will require him to sign 10 collections per year across men’s, women’s and haute couture while continuing to lead his namesake brand.

ADVERTISEMENT

‘One’ Big Dior

Bringing on a single creative director across women’s and men’s for the first time since launching Dior Homme in 2001 signals a renewed will on the part of LVMH to craft a more coherent, unified message at Dior. While forging “One Dior” has long been a key pillar of LVMH’s strategy, the brand’s message remains fragmented, with lingering disconnects in aesthetics, storytelling and underlying values across menswear, womenswear and perfume ranges like Sauvage and Miss Dior.

Anderson will still need to carefully calibrate the brand’s message to address a range of audiences. While fashion superfans are looking to Anderson to restore Dior’s position as a groundbreaking force in couture creativity, the brand also needs to re-engage wealthy clients looking for desirable bags, sneakers and gowns after prices soared and creativity stalled in recent seasons. Over at sister company Parfums Christian Dior, which manufactures the brand’s skincare, makeup and best-selling perfumes, teams are crossing fingers for a refreshed fashion halo that can sharpen the brand’s cool factor without alienating its sprawling mass-market audience.

Investors, too, are counting on Anderson to engineer a turnaround: Where Dior used to represent a drop in the bucket for LVMH’s bottom line, the brand now accounts for 14 percent of operating profit, according to HSBC estimates. From 2017 (when the group took full control of the brand, which had previously belonged to the Arnault family’s holding company) through 2022, revenues tripled and operating profit grew seven-fold under former CEO Pietro Beccari, former womenswear designer Maria Grazia Chiuri and former menswear chief Kim Jones.

Sales continued to rise in 2023 (buoyed by steep price hikes), crossing $10 billion in estimated annual sales before reversing course last year amid a global slowdown in demand for luxury goods. Estimated revenues slid 6 percent excluding currency shifts in 2024, and are expected to fall by another 10 percent this year.

“As a client, you have not had a lot of reasons to push the door at Dior, lately, as at most places selling handbags and accessories,” HSBC analyst Erwan Rambourg said. “You’ve had greed-flation” — price hikes without corresponding product innovation that far outstripped the rate of inflation — ”and there’s a lack of creativity. [Luxury] is a sector that has been incredibly complacent,” HSBC analyst Erwan Rambourg said.

That’s a more modest dip than the vertiginous slides reported by Gucci or Burberry. Still, it’s attracted the attention of investors who would have previously focused their scrutiny on Louis Vuitton, the group’s biggest and most profitable brand. In recent quarters, analysts have pressed for clarity on the plan for Dior, as well as at beverages unit Moët Hennessy, which is laying off 10 percent of staff after it reportedly turned loss-making last year.

LVMH shares have fallen 50 percent from their 2023 peak, underperforming Hermès (which raised prices more cautiously since the pandemic, sidestepping the sticker shock that’s caused many clients to snub luxury fashion) and Prada (which took bolder steps to refresh its product offer and marketing, particularly at sister brand Miu Miu).

Leadership Shakeup

In recent months, LVMH reinforced leadership at its biggest units: former CFO Jean-Jacques Guiony and former Tiffany CMO Alexandre Arnault were brought in to turn around Moët Hennessy, while Louis Vuitton named a new deputy CEO, Damien Bertrand.

ADVERTISEMENT

The group also named its first “industrial and craftsmanship director,” Ludovic Pauchard, to “ensure operational excellence across the entire production value chain, while upholding LVMH’s commitments regarding ethical conducts, vigilance, environmental protection and social responsibility.” The move comes as brands including Dior need to race refreshed designs to market while avoiding being tangled up in manufacturing scandals — the brand’s reputation took a serious blow last year when it was called out by Italian authorities investigating the use of sweatshops in luxury brands’ supply chains.

At Dior, CEO Delphine Arnault (owner Bernard Arnault’s oldest child) is now seconded by two new managing directors, Benedetta Petruzzo and Pierre-Emmanuel Angeloglou. Petruzzo was hired fresh from a star turn leading Prada’s Miu Miu; Angeloglou is a former L’Oréal executive who previously worked alongside Ms. Arnault as executive vice president at Louis Vuitton.

LVMH is adept at investing through downturns — maintaining the pace of marketing, store renovations and product launches that drive market share gains once demand rebounds. That approach helped it to brush off previous crises in 2001, 2008 and 2020.

In addition to rolling out its revamped designer vision, this time Dior is forging ahead with investments in expanded flagships in New York’s Madison Avenue and Los Angeles’ Rodeo Drive. (Even as sales decline sharply elsewhere, business has been more resilient at the brand’s Paris mega-store opened in 2022, where a fashion museum, restaurant and café help it to stand out as a destination).

Following the menswear show Friday — a relatively circumspect affair for 600 guests — Anderson will dive into preparing his first womenswear outing in October as well as his January 2026 couture debut.

Dior has traversed multiple creative transitions before: including the exits of previous designers John Galliano, Hedi Slimane and Kris van Asshe — prior to this year’s exit of Jones and Chiuri.

But where sustained demand from Chinese clients helped push the brand over previous speed bumps, the current team is seeking to relaunch sales in a much trickier economic context: the key Chinese market remains depressed, while many wealthy US customers have halted big-ticket purchases as stock markets yo-yo in response to Trump’s trade war.

“No one wants to buy luxury right now. People are stressed; they aren’t feeling bullish about the future. If no one wants to buy, the message can’t be confusing or lack consistency,” Rambourg said.

ADVERTISEMENT

The brand is also a much bigger business than during previous designer transitions, making a radical shake up to its marketing message and design that much riskier. Anderson will need to avoid throwing out the baby with the bath water — renewing excitement for the brand while limiting disruption to the various product lines that still power billions in annual sales. His predecessors’ products will continue to loom large in stores well into 2026.

Another teaser posted last week suggested Anderson will take a conciliatory stance to blending the old with the new: the designer’s first bags were riffs on his womenswear predecessor Maria Grazia Chiuri’s signature Book tote, this time embroidered with retro book-cover designs referencing Dracula and Liaisons Dangereuses, which recalled the work of Olympia Le Tan.

Anderson is “not someone who disrupts just to be disruptive,” said Ezra Petronio, art director and founder of Self Service magazine. “He revisits the past, engages the present and creates the future. He’s respectful of what a brand is but doesn’t get caught up in it.”

Disclosure: LVMH is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholders’ documentation guaranteeing BoF’s complete editorial independence.